The Australian Federal Government has recently announced an extension to the JobKeeper scheme which will effectively extend the scheme for a further six months until 28 March 2021.

Key points to note are:

- The existing JobKeeper rules will continue to apply as originally introduced until 27 September 2020.

- The JobKeeper Extension will apply for an additional 6 months from 28 September 2020 until 28 March 2021.

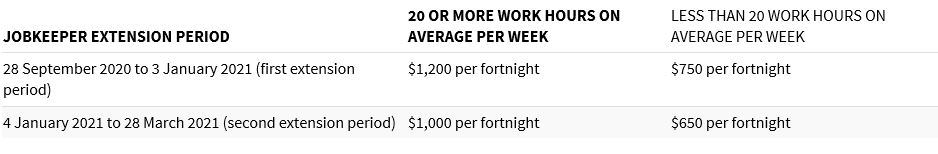

- The current $1,500 per fortnight JobKeeper subsidy is to be reduced to the amounts noted in the table below with effect from 28 September 2020. Under the JobKeeper Extension, the turnover tests will now be based on actual rather than projected turnover.

- The existing JobKeeper and JobKeeper Extension will be available to new participants if the relevant tests are met.

Worker Eligibility

The current $1,500 JobKeeper payment will be reduced and the level of payment will depend on whether the employee or business participant worked

at least 20 hours per week in the 4 weeks prior to 1 March 2020.

The table below outlines the payment amount after 27 September 2020

Employer Eligibility

The JobKeeper Extension has effectively two testing periods to measure decline in turnover:

- 28 September 2020 to 3 January 2021 (first testing period)

- 4 January 2021 to 28 March 2021 (second testing period)

Under the first testing period, businesses must satisfy the 30% decline in turnover test based on actual turnover during the quarters ending June 2020 and September 2020. This is compared to the same period in 2019.

Under the second testing period, businesses must satisfy the 30% decline in turnover test based on actual turnover for the quarters ending June 2020, September 2020 and December 2020. This is compared to the same period in 2019.

The alternative test will continue to apply.

What do do next?

Please ensure your record keeping systems are accurate and up to date for the purposes of assessing the turnover tests.

If the business satisfies the turnover test then the employees payroll records will need to be reviewed to determine whether they have worked 20 hours or more in the February 2020 period.

For further support on the new changes to JobKeeper, contact us.

We are committed to assisting you through these challenging times.